|

|

|

|

| |

|

|

|

|

|

Year 2002March 2 |

Did My Taxes on Time This Year

Well, for the first time in two years, I did my taxes on time yesterday. See Taxes 1999 and Taxes 2000 for the story of what happens if you put off filing your taxes for too long.

This year, I did them early because today is the deadline to apply for the FAFSA, the Free Application for Federal Student Aid (see http://www.fafsa.ed.gov/), for graduate school during the next academic school year. For part of that application, you need to know some numbers from your federal tax return, so I did them early. I still need to do my California state taxes.

I was curious about how much tax I have been paying the federal government over the past few years, so I made the following chart.

Year Real Income Tax Paid Percent Taxable Income Percent Employer 2001 $24,308.01 $1081 4.45% $13,866.56 7.80% Biola 2000 $27,445.04 $2591 9.44% $17,262.33 15.01% IRSC, Biola 1999 $44,846.32 $6544 14.59% $35,306.05 18.54% ICC, IRSC, Biola 1998 $40,580.63 $4244 10.46% $26,902.45 15.78% ICC, Biola 1997 $37,249.92 $4811 12.92% $28,649.92 16.79% ICC 1996 $33,896.46 $4545 13.41% $27,358.19 16.61% ICC 1995 $32,279.00 $4210 13.04% $25,879.00 16.27% Kohlenberger, ICC 1994 $29,860.00 $3658 12.25% $23,610.00 15.49% Kohlenberger I graduated from college in May 1993, so 1994 was the first year I worked full-time. The "Real Income" listed above is the total amount of money I got paid (from Box 1 of my W-2 forms). That's the "real" income because that's the money I actually earned that year. The federal government then calculates a "taxable income", and that's what the tax is based upon. But it's sort of a made-up number, adjusted by deductions.

I claimed a "capital loss" of $1800 in 1997, then $3000 every year after that, and I will claim $2999 in 2002. That directly reduces my taxable income. This capital loss is due to $15,000 worth of stock market folly in late 1997 and early 1998. There's also a standardized deduction that you can deduct. I itemized my deductions in 1998 only.

In 2001, I paid $5200 in tuition to USC, so I received the maximum $1000 tax credit -- the "Lifetime Learning Credit". That directly reduced my taxes in 2001 by $1000. Without that, my tax rates would have been 8.56% and 15.00%.

It's also interesting to note that I made less money in 2001 than in 1994. However, I was much happier with work in 2001 than in 1994. I got 6 weeks off for Christmas, and three months off during the summer. In 1994, I think I only got a few weeks off all year. I'll have to write an article about that sometime, and an article about my employment history.

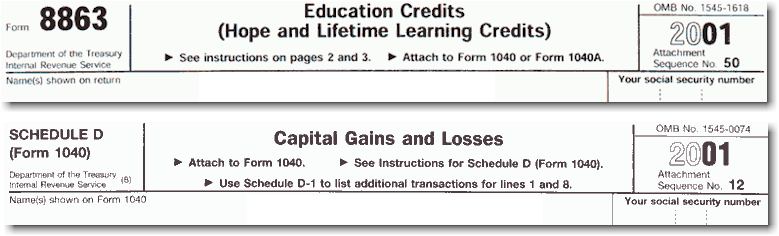

After looking at my copies of what I sent in, I realized that I forgot to put my name and social security numbers on two of the forms! (See below) Oh well, I'll find out what happens, I guess. It's stapled to my 1040, so I think it will be okay. I hope it doesn't delay my refund.

![]()

Created and maintained by Matthew Weathers.

Last updated Apr 20, 2006.

![]()